What is Capitalization?

Capitalization in business is like watering the plants

Happy day, amazing people!!!

We water the plants for them to grow and reap us the benefits. They don’t require huge amount of water or can survive with few drops. They require only the amount they needed.

Don’t you guys think in a way that this principle applies to capitalization.

Meaning of Capitalization

Capitalization is the sum of the total owned (equity) and borrowed (debt) capital that a firm needs to run its business.

Some scholars say that capitalization also includes the decision of determining the types and proportion of securities. But others say that it doesn’t include the decision of determining the types and proportion of securities because they feel that it comes under a separate topic called capital structure.

Anyways,

These raised capitals are invested into the business for its operation.

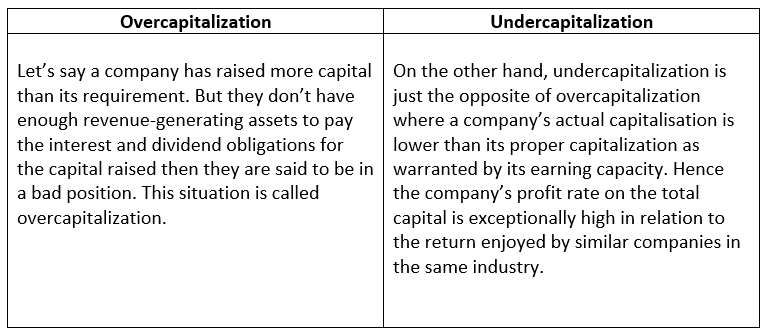

Types of Capitalization

Example

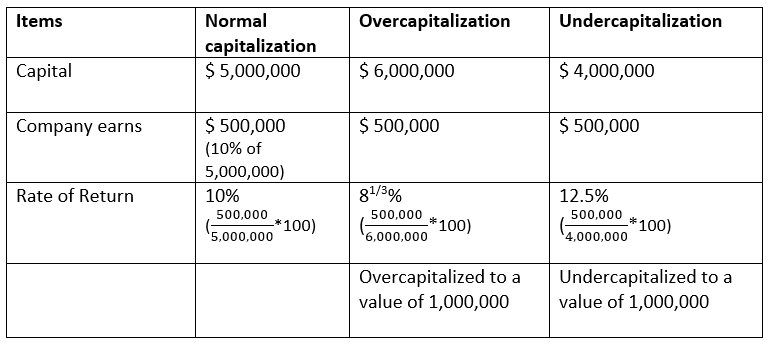

Let’s assume ABC company earns $ 500,000 and the average rate of return in the industry is 10%. So, the normal capitalization would be $ 5,000,000 ($500,000/10%). Now let’s see what happens when ABC company is over or under capitalized.

We hope you guys have understood about capitalization and its types.

Ok then, before signing off

Love what you do, do what you love…. Bye

From,

Simply grasp