Fee Based Financial management

Having a tool box is best

Happy day, amazing people!!!

We need someone or something to organize, arrange and manage our activities otherwise we would feel all over the place. Below are some of the services provided by professionals (like merchant banker, portfolio manager, investment banker, etc.) for fee. These services are provided for organizations as well as for individuals.

Synopsis

| Mergers & Acquisition |

| Portfolio Management |

| Credit syndication |

| Credit rating |

Mergers and Acquisition

Merger means two or more companies join together to form a new company. For example, let’s say Phoenix mass media company wants to merge with Alive animation studio company. The resultant new firm will be Phoenix Alive company. The name may or may not be the blending of the original company’s name.

Acquisition happens when one big company acquires the smaller companies. The acquisition can be friendly or hostile. From our previous example, if Phoenix mass media conglomerate company wants to buy Alive animation studio company with their consent, then it is called acquisition otherwise it is known as takeover.

Before jumping into Merger and Acquisition (M&A), the companies must check for synergetic effect (means the combined value and performance of two companies will be greater than the sum of the separate individual company). Since Alive is an animation company, it’s works can be used in mass media. So, there exist a synergy between Phoenix and Alive. Then the companies must also check for whether M&A are really worth the time. Research has to be conducted to check the future of the M&A proposal. For this purpose, criteria like growth potential, profitability, effectiveness, market power, cost reduction and leadership are considered. If they find it feasible, then they can go ahead with merger and acquisition.

Portfolio management

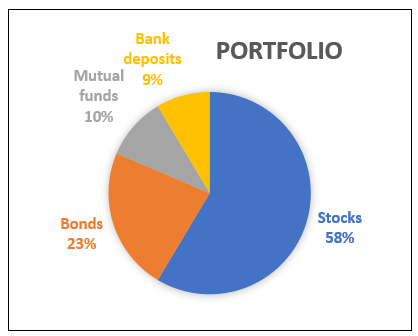

Think of portfolio as a pie chart, which represents different percentage of securities held by individuals and organization. Portfolio manager manages the securities (like stocks, bonds, mutual funds, etc.) based on their client’s requirements.

Sample representation of portfolio

For example: Jacob is a young individual, who is in late twenties and has more appetite for risk. In this case, the Portfolio manager will invest in high risky stocks which has high returns. On the other hand, Kevin, who is an old grandpa and has low appetite for risk. His investment will be on bonds with regular income.

Portfolio manager will adjust the portfolio according to the changes in price and risk involved in the securities.

| Do you know ? |

| If you make money on investment, you are only required to pay taxes on the capital gains (or the extra money earned), not the original amount you invested |

Credit Syndication

When a group of lenders provide financial assistance to single borrower/single cause then it is called as credit syndication. The reason for many lenders is that a single lender will not be able to provide such a huge loan to borrower. Merchant banker is the one responsible for organising and procuring the financial assistance.

For example: A metro station has to be built. Merchant banker must approach the possible lenders for loans. He/ she must also draft the necessary paper work regarding the project details along with compliance work according to various acts.

Credit rating

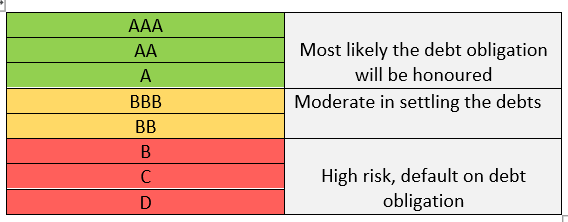

Credit rating is done to know the credit worthiness of the borrower that is whether he/she will be able to repay the loan. Not only companies even individual and countries can have credit rating. Some of the criteria that the credit rating agency take into account for companies are business analysis, industrial risks, market position, operating efficiency, labor turnover, financial analysis and so. Different credit rating agency have different symbols to represent their grade.

Sample symbols of credit rating

We hope you guys have understood about the fee based financial management concepts with these examples.

Ok before signing off

Love what you do, do what you love…. Bye

From,

Simply grasp