How to interpret ratio analysis?

Happy day, amazing people!!!

If you are a finance nerd, please skip this article. We know you guys can read between numbers but this for some people like us who need simplification.

Just Kidding!

Ratio analysis is a snapshot of how a company performs in a particular time frame. These results are used by financial analysts, equity research analysts, investors and asset managers to make better investment decisions.

Types of Ratios:

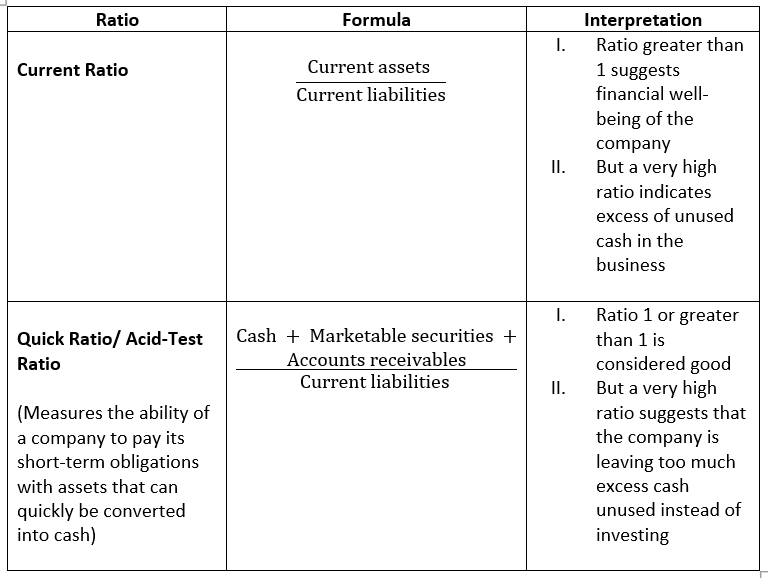

Liquidity Ratios

These ratios measure whether the company will be able to repay its short-term debt obligations.

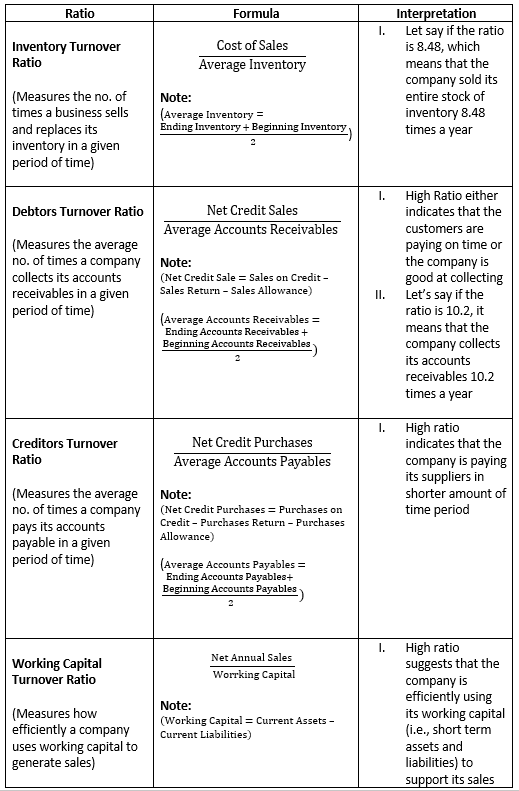

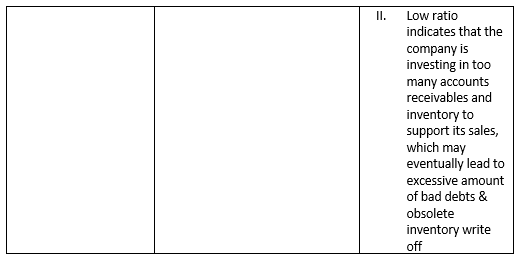

Efficiency ratios

These ratios measure how well a company utilizes its assets and resources.

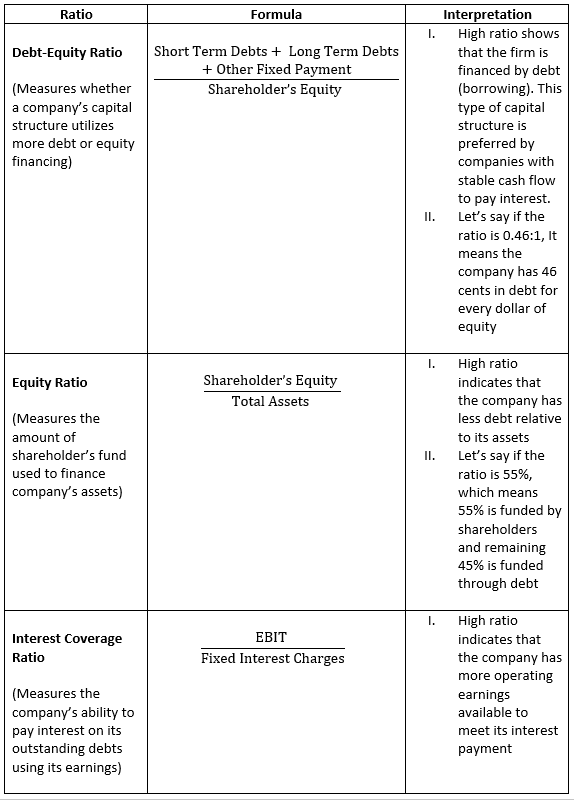

Solvency Ratio

These ratio measures how the long-term funds are used in the company.

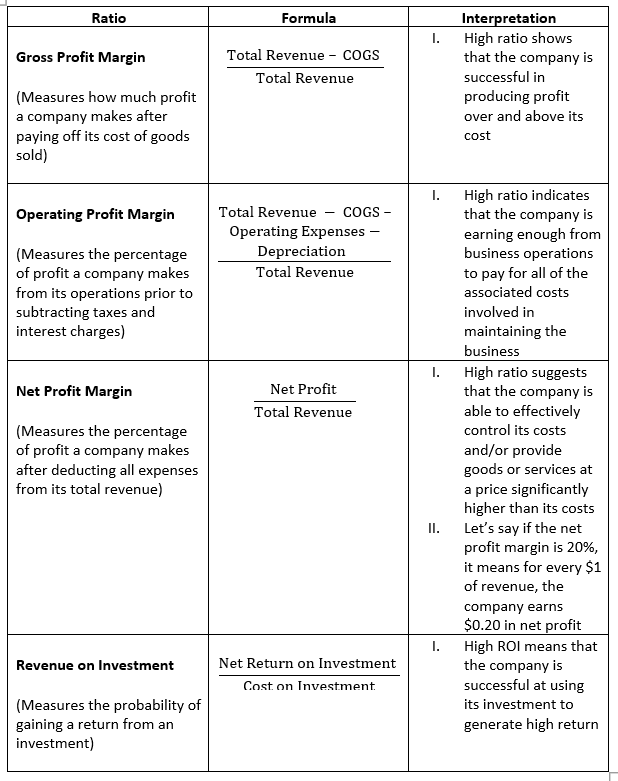

Profitability Ratio

These ratios measure how efficiently a company generate profit and value for shareholders from its sales/operation, balance sheet assets, or shareholder’s equity.

We hope you guys have understood about ratio analysis and its types.

Ok then before signing off

Love what you do, do what you love…. Bye

From,

Simply grasp